Announcement : Acquisition of All Shares of Fine International Co., Ltd.

January 28, 2022

TOWA Corporation has acquired all shares of Fine International Co., Ltd.(hereinafter referred to as “Fine International”), a Korean company, on January 26, 2022 and made it a consolidated subsidiary. The detail is as follows.

1.Reason for the acquisition of shares

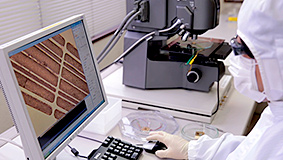

Fine International is a company that manufactures and sells blades based on the cutting technology required in the electronics industry field, and realizes miniaturization of electronic components and processes precision parts with its technology using high-speed rotating blades.

We consider that by making Fine International a consolidated subsidiary, we will be able to combine Fine International's cutting technology with our singulation technology, develop new products (Singulation equipment and Blades), and expand earnings from our TSS (Total Solution Service) business including sales of blades.

In addition, we aim to achieve synergy and hike corporate value through exchange of both engineers, mutual use of sales and service networks, and flexible use of procurement resources for production (price and delivery deadline).

2.Overview of the subsidiary to be transferred

| (1)Company name | Fine International Co., Ltd. |

| (2)Address | Banwol IND,COMP,10B-20L,24,Beomjigi-ro 141beon-gil,Danwon-gu,Ansan-si,Gyeonggi-do,Korea |

| (3)Title and name of representative | Representative Director, Seung Seop Ko |

| (4)Business field | Manufacture and sales of blade |

| (5)Amount of capital | 1.3 billion won |

| (6)Date of establishment | April 25, 1994 |

3.Title and name of new representative

| Representative Director, Sangyoun Han | (Senior Executive Officer of TOWA Corporation and Representative Director of TOWA Korea Co., Ltd.) |

4.Overview of the counterparty on the share acquisition

Since the counterparties for the stock acquisition are individuals(Fine International's Management and their relatives), we refrain from disclosing details. The counterparties and we have no capital relationship, personal relationship, and business relationship to be mentioned. And also, they are not related parties.

5.Number of Acquired Shares, Acquisition Price and Shareholding Status Before and After Acquisition

| (1)Shareholding Status Before Acquisition | 0 share (Proportion of voting rights: 0%) |

| (2)Number of Acquired Shares | 260,000 shares (Proportion of voting rights:100%) |

| (3)Shareholding Status After Acquisition | 260,000 shares (Proportion of voting rights:100%) |

| ※ | The acquisition price cannot to be disclosed on account of a mutual agreement but when calculating acquisition price, we conducted due diligence by a third-party organization and determined reasonable price by mutual agreement. |

6.Future Outlook

Impact of this transaction on the TOWA's consolidated business performance for the fiscal year ending March 31, 2022 is little. In addition, the sales of Fine Technology for the fiscal year ending March 31, 2023 is planned to be approximately 500 million yen.

We will announce as soon as possible if a matter to be disclosed occurs.

(END)

From Kyoto to the World

From Kyoto to the World